Most Read

Banks May Refund More Zelle Scam Victims in 2023

Protect Your Funds: 6 Safe Ways to Send Money in the U.S.

Venmo, Cash App, Zelle: Scammers Posing as Fraud Department

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

Real Chase Fraud Text Alert or Scam Message?

Zelle In Depth

Zelle is a U.S.-based payment network owned by Bank of America, BB&T, Wells Fargo, US Bank, Capital One, and JPMorgan Chase. Zelle allows users of the app that have a bank account with one of the member banks to send payments to any other Zelle app user that also has an account with one of the banks without any fees. Since the Zelle member banks account for a large percentage of U.S. bank accounts, Zelle has become a popular, convenient way to send money—it is now Venmo's main competitor and, unfortunately, a target of scammers.

If you have an account with one of the member banks, getting started with Zelle is easy. It is already built into thousands of banking apps. People who don't have access to the Zelle app in their banking app can download the Zelle app from either the iPhone App Store or Google Play.

Zelle

Website: https://www.zellepay.com/

Contact page: https://www.zellepay.com/support/contact

Contact page: https://www.zellepay.com/support/scam

It's important to verify links and contact details to beat imposters.

Types of Scams Targeting Zelle Users

Scammers will use many techniques to trick you out of your hard-earned money. Here are some of the widespread scams that target Zelle users.

Zelle Bank Impersonation Scam

For this scam, the scammer will need your cell phone number and your bank account number, which they most likely got through a data breach. They will call you on the phone claiming to be from the fraud department of your bank. The caller ID may even show the call is from your bank—a trick called call spoofing.

The caller will say that fraud was detected on your account, and they are calling to help you take care of any fraudulent charges. The caller will ask you to open up your banking app and enter a verification code. But what the scammer is actually doing is signing up for a Zelle account using your details. The verification code will give the Zelle app on the scammer's phone access to your account, and the scammer will empty your account.

Zelle Cash Flipping Scam

In this scam, known as cash flipping, the scammer will tell you they can get great returns on your money in a very short time. For example, the scammer will claim that your money could double or triple if you send it using Zelle right away. However, as soon as you transfer the money, it is gone, and you will see no returns.

Zelle Online Purchase Scam

In this scam, the scammer will offer tickets, puppies, or another product in an online marketplace. One common place is Craigslist because creating a new ad is simple and can be anonymous. When you email or message the seller about purchasing the item, the seller will ask that you pay them using Zelle.

Since Zelle is a legitimate payment service, you are happy to do so. What could go wrong? The scammer then never sends you the item and takes off with your money, taking advantage of the fact that all payments using Zelle are final.

Zelle Fake Charity Scam

This is a simple scheme that scammers use to prey on people who donate to charities. They will set up a fake website or social media profile and ask for donations, only accepting payments using Zelle. Any donations made go straight into the scammer's pocket, and the fake charity will disappear from the internet within a few days.

How to Beat Zelle Scams

The best way to prevent yourself from falling victim to a Zelle scam is by protecting your accounts and knowing the red flags of fraud. Here are some tips:

- Sign up for alerts from your bank: Sign up for text or email alerts for any activity on your bank accounts, so you can catch any fraud early and stop it.

- Don't use Zelle to make payments to people you don't know: Once you send a payment through Zelle, you cannot get it back. Zelle can be used to send payments to people you know but is not recommended for online purchases or sending money to people you don't know.

- Be suspicious of phone calls and emails regarding your Zelle account: Don't trust phone calls and emails where you are required to use Zelle. Never click on a link in an email that claims to be about your Zelle account.

- Use multifactor authentication on your financial accounts: This will add another layer of protection to your accounts so that scammers can't access your account even if they have your login credentials.

- Use strong passwords on your financial accounts: This is a must in today's internet landscape. Always use a strong password in your accounts that are only used once and change them often.

Protection Against Zelle Scams

If you have fallen victim to a Zelle scam or have been contacted by a scammer, here are some things you can do.

Contact Your Bank

If a hacker has gained access to your bank account and made a payment through Zelle, that is fraud, and you should report that to your bank right away. Your bank will identify all the fraudulent charges and stop any future fraudulent payments from your account. In most cases of fraud, you will get your money back. You should also call Zelle at 1-844-428-8542 to report the unauthorized transaction.

If you authorized a Zelle payment yourself to purchase a product or service you never received, you might not get your money back. But you should still contact your bank and give them the details of the scam to see if there is anything that can be done.

Report the Scam to Zelle

If you have been scammed out of money using Zelle, report the scam to Zelle. Zelle has an online form to report scams. They categorize scams as merchandise, property, jobs, imposter, charity, investment, and romance. Have all your details ready, because the form is extensive. They will report the incident to the affected banks to prevent the same thing from happening to anyone else.

Report it to Authorities

If you've fallen victim to a Zelle scam, report it to the authorities, like:

- Your local police

- The Federal Trade Commission (FTC)

- The FBI

Although they may not help you get your money back, reporting Zelle scams to the authorities can help them catch the culprits.

Scams Impacting Zelle

Venmo, Cash App, Zelle: Scammers Posing as Fraud Department

Beware of calls from the "Fraud Department" of mobile payment apps like Cash App, Venmo, and Zelle—you could lose all of your money in seconds.

Selling on Facebook Marketplace? Beware of Fake Venmo Emails

Scammers are sending fake Venmo emails to Facebook Marketplace sellers in an attempt to steal login information and money.

Citibank Text Message Scam: Locked Debit Card Alert Is Fake

If you've received a locked debit card text message from Citibank, it's likely a scam. Don't click on the link and delete the text message.

Real Chase Fraud Text Alert or Scam Message?

If you receive a text message from Chase Bank, don't click on any links or call the phone number listed—it could be a scam designed to steal your information and money.

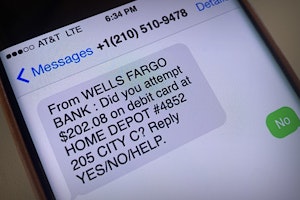

Wells Fargo Text Alert - Is It A Scam?

Dangerous text message scams are targeting Wells Fargo customers. These text message alerts for Zelle transactions or purchases with retailers are scams.

Capital One Fraud Text Alert Scams: Spotting a Fraud

If you received a suspicious Capital One fraud text alert, it may be a scam. Learn how to spot the fake to protect your identity and funds.

PayPal Text Scam: Identify a Fake & Protect Your Money

Several versions of fake PayPal text messages are being sent to people worldwide. There are a few easy ways to tell which messages are scams and simple things you can do to protect yourself.

Venmo Text Scam: Don't Fall For These Fake Messages

If you received a text from Venmo with a link to verify a payment or deposit, or are asked to complete a survey in exchange for money, it may be a scam.

Free PayPal Money Scams: Don't Believe the Hype, It's a Scam

Multiple free money scams that easily fall under the “too good to be true” scams that target loyal PayPal users with promises of free PayPal money.

How to Avoid PayPal Shipping Label Scams: Top Tips

PayPal is a convenient way to pay for online purchases and has a reputation for safety and security. But scammers still find a way to use PayPal to help them steal products.

Guides To Protect Against Banking & Finance Scams

Protect Your Funds: 6 Safe Ways to Send Money in the U.S.

Nowadays, there are many options for quick peer-to-peer money transfers. Here are six safe ways to send electronic funds via mobile payment apps.

Beat Cash App Scams and Stay Safe When Transferring Money

Cash App may be a convenient way to send and receive money from friends and family, but it's also a common target for scammers who are out for your money.

How to Beat PayPal Scams and Keep Your Money Safe and Secure

Whether you use PayPal for personal use or business transactions, scammers are out to get you. It's what you know and how you act that will keep your money safe.

How Alliant Credit Union Protects You From Scams

Alliant Credit Union has several security protocols in place to help protect you from fraud and scams, including ways to recover lost funds or limit your losses.

5 Things to Do After a Data Breach to Protect Yourself

When a company is the victim of a data breach, it's completely out of your control. However, there are steps you can take afterward to protect your information and money.

News About Banking & Finance Scams

Banks May Refund More Zelle Scam Victims in 2023

Zelle scams have reached a serious volume. New reports suggest that banks are looking at new refund protections for customers in 2023.

RobinHood Customers Are About to Be Phished—Here's What it Will Look Like (Examples)

Robinhood's latest data breach of 5 million email addresses means that Robinhood users are about to encounter a wave of phishing attempts.

Robinhood Users: Look Out for Scams Following Data Breach

Robinhood recently suffered a massive data breach, exposing the information of millions of users.

Urgent CDC Warning: Eye Drops Linked to 3 Deaths, Loss of Vision

The CDC is warning eye drops users of a rare bacterial infection from 2 brands of eye drops. The infection is resistant to antibiotics and has resulted in the loss of vision, loss of eyeballs and the death of 3 patients.

Optus Data Breach - One of the Worst Cyberattacks in Australia

Hackers have gained access to 9.8 million customer records from Optus in Australia, exposing personal information such as driver licence, medicare and passport details.